Accounting Templates – A small business plan template is a must-have for any business owner. Many small-business owners, on the other hand, fail to take advantage of this crucial management stage.

Table of Contents

There are a lot of Myths about Budgeting

However, the procedure can be simplified if you have a decent general ledger template.

Effective budget templates for small businesses are dynamic documents. Making a budget and afterward putting it on the back burner is a waste of time and effort. In order to keep track of your progress, it’s critical that you do so on a frequent basis.

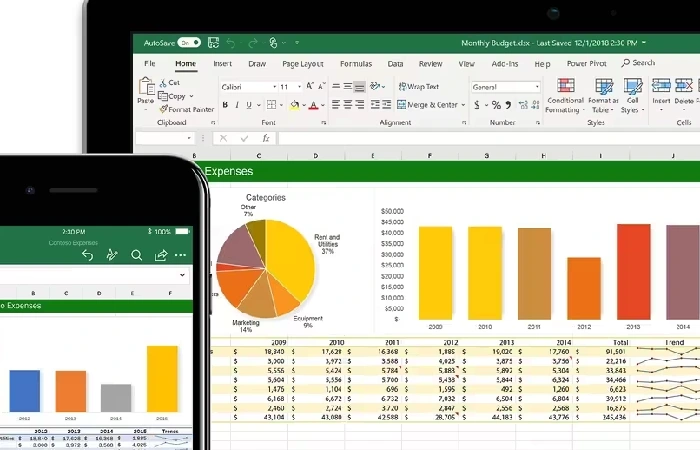

Consequently, your budget must be accessible and able to update frequently. If you don’t have a lot of money to spare, you don’t need any expensive budgeting software.

Why you should use an Online Company Budget Template?

Company owners who wish to keep an eye on their bottom line can use a business budget template.

What are the Benefits of Starting with a well-thought-out Template?

How such a business budget template can put you up for success is explained here –

- Keep a close eye on your finances, both income and expenses.

- Consider the possibility of recurring business downtime.

- Spend your money on the areas of your firm that are most in need of funding.

- Be prepared to make commercial purchases and investments.

- Estimate all of the expenditures associated with launching and running your firm.

If you take the time to draw up a solid business budget template, you can use it as a business health rating.

A Checklist of the Best Free Accounting Program Options

Accessibility

If you’re looking for free accounting software, you don’t have a formal education in accounting. In order to expand your business, you need to keep an eye on your long-term goals and your day-to-day activities. A complicated, too technical accounting software isn’t something you need to spend too much time and energy understanding just yet.

It’s to your best advantage to use a user-friendly and uncomplicated accounting platform as your firm grows. Prioritize accessibility while you’re looking for free accounting software for your business.

The ability for users to link their Accounts to their Credit and Debit Cards Accounts

Businesses, especially those with significant transaction volumes, may find that manually entering receipts is an enormous time sink. Finding free accounting software which can connect to your credit and debit card accounts is always a smart idea when you’re looking at your possibilities.

Possibility of Record Export

Any company growing beyond the limitations of free accounting software is going to run into problems. After seeing that kind of development, you’ll undoubtedly desire more expensive accounting software. But the data you’ve accumulated in your free solution doesn’t go away when you switch to a paid service.

The Particular Features You Require

If you’re looking for an accounting solution, it’s important to keep in mind that your business is your business, and you have unique demands and goals.

Limitations of Free Accounting Software

The Number of People Using the Service Is Limited

For the most part, free accounting software lets you offer access to only a small number of users, often just one. If you need to make use of the solution on a regular basis by a large number of employees in your business, you may want to consider paying for it.

Inability to Scale

The number of transactions or records you’re allowed to keep in some free accounting software may be limited. As your business grows, you’ll likely be confronted with more of both of these issues. A free accounting solution may not be sustainable in some instances.

Your Data Migration Is Difficult

Keep this in mind while deciding on free accounting software; some are more difficult and time-consuming to use than others.

When is it time to Upgrade from Free Accounting Software?

It’s up to you to decide whether or not to upgrade from your current system. Paying for a paid program may be necessary if you’re taking on more customers or processing more payments than your free application allows.

So, if your free accounting software isn’t cutting it anymore, look for a more cheap alternative that can accommodate your changing needs.